IPA, Malaysia’s

premier training provider since 1991

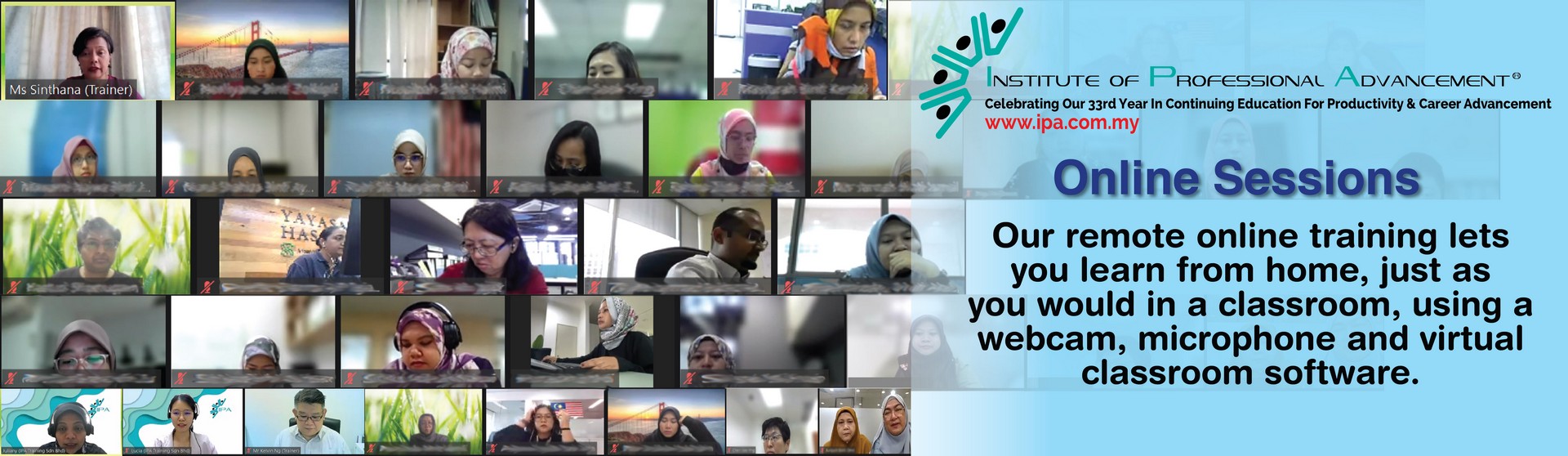

When you're trying to build and maintain a positive, productive workforce, training is one of the linchpins to successful results. And when it comes to employee training, you need to look no further than IPA-Institute of Professional Advancement.